Understanding Trauma And Its Impact On Your Financial Life

Sep 08, 2021

Everyone has trauma. Whether it’s large traumas or small daily traumas, these inevitably impact your financial life.

Your sense of security in the world is impacted by how your nervous system responds to these past traumas, even without you realizing it.

Read more about this automatic response to trauma and what to do about it.

What Happened To You vs What’s Wrong With You

I love listening to books. Recently I heard Oprah and Dr. Bruce Perry’s book, What Happened To You?: Conversations on Trauma, Resilience, and Healing, and I was deeply moved.

Oprah and Dr. Bruce Perry do an incredible job weaving together the stories and research of how your past shapes who you become.

They challenge your very paradigm of how you understand mental health. Shifting the conversation from what is wrong with you (anxiety, depression, bipolar, ADHD/ADD, etc.) to what happened to you.

It turns out that changing this paradigm is the royal road to help you heal and grow.

Not everyone has heard of Dr. Perry. He is a leading scientist on attachment theory, which is the study of how people grow, develop, and maintain caregiving relationships.

He shares an incredible story of how he has grown into the position of looking at what has happened to you over what is wrong with you. If you are new to the intersection of trauma, attachment, and later-life mental, and physical health this book is a great primer.

Let me just say I was struck by Oprah's capacity to actively reflect on her own trauma and its impact on her life. A huge sign of trauma recovery and resilience. No, it has not been an easy journey for her but she coherently talks about what it has taken to get to this place.

If you are further along the journey, you will take solace, as I did, in revisiting key ideas about the impact of childhood trauma on adult outcomes.

The great news is it is not all doom and gloom, but it is a real look at the implications of childhood adversity on adult well-being outcomes.

There is so much to learn from this wonderful book. I am going to share just one of the many lessons I gained.

The Level of Threat Your Body Perceives Impacts Your Functional IQ

Making informed and thoughtful decisions about our finances is a complex process that requires your ability to be creative, daydream, reflect and think critically.

When your nervous system is calm and perceives your partner’s nervous system as calm you are able to access those very abilities.

If your nervous system perceives a range of threats, your functional IQ drops.

When your functional IQ drops it has negative implications for the way you make financial decisions.

Dr. Perry includes a powerful chart describing this in the book.

In the chart, Dr. Perry identifies 5 levels of state-dependent functioning and their impact on functional IQ.

This simply means that as your environment changes your state of mind and arousal level can change, which then impacts your ability to handle more complex thinking changes.

Complex thinking is necessary for solving many of your financial dilemmas, but not threats that involve your safety. The challenge is that many money situations get misperceived as life or death situations either consciously and unconsciously and lead you to make what might be regrettable decisions in hindsight.

State - Functional IQ

Calm - 120 - 100

Alert - 110 - 90

Alarm - 100 - 80

Fear - 90 - 70

Terror - 80 - 60

What does this mean for you, your partner, and your finances?

When you are not feeling safe with each other your ability to problem solve through your financial distress is going to be reduced by the degree of perceived threat.

This sounds easy to identify, but I have often seen clients where they are not able to recognize either their own level of threat or that of their partner, which is a major part of what blocks them from moving forward together.

Learning to pay attention to the body for the true level of threat is a core skill necessary for improving your ability to move through difficult financial conversations.

What Happened To You Financially

While it is very normal either to not want to look at the past or become fixated on some aspect of the past, these patterns both represent traumatic orientations to your past.

Being able to face your past from a place of reflectivity, integration, and growth is developed over time and can help you to improve your financial life.

I would like to introduce you to one category of trauma. Financial trauma.

Financial Trauma

Financial trauma is more complex and dynamic than you might expect.

So take your time and meet yourself where you are on this journey. Let this be a time to open and expand your understanding of what can be financially traumatizing. I would ask you to think about how this applies in your own life and in your partner's life.

Although financial trauma happens to many members of society. For the time being, let this be about you and your partner.

Financial trauma comes into two big types. Big T and little t financial trauma.

If you have been learning about trauma for some time then you probably recognize the Big T and little t framework.

However, if this is new to you then let me give you a short introduction.

Big T Trauma

Big T traumas are typically large and easily recognizable as having the potential for being traumatic.

Think about newsworthy events like losing millions of dollars.

Little t Trauma

Meanwhile, little t trauma happens every day and may be personally really big to you but not necessarily a big deal to another person.

If it creates emotional pain (anger, sadness, anxiety, shame, fear) then you need to pay attention and see if it is still having an impact on your life.

Not all painful experiences become traumas that limit, impair or reduce your ability to enjoy life, but there are many that do without you even realizing it.

Ultimately financial trauma can be a wide range of adverse financial experiences that disrupt your sense of normalcy, safety, security, and emotional stability.

They often also happen between one or more people and have a relational component where relationship security is threatened or perceived to be at risk of loss.

What makes it traumatic is when the significance to you goes unacknowledged. When you can make meaning and sense out of painful experiences it will often help to buffer the adverse impacts of the experience.

Top 10 Childhood & Adult Financial Traumas

There are some major themes that continue to show up in my client’s lives around money and adverse experiences.

Seldom is it money alone. Rather, it’s the way that you or the significant people you are related to interact with money.

Please know this list does not encompass all possible experiences and is in no particular order.

However, I would like you to start considering how past financial adversity may be impacting your adult relationship with money.

- Parental divorce and financial changes/adversity

- Parental & personal job loss

- Parental conflict about earning, savings, work

- Change in social class & issues related to social class

- Economic shifts abrupt and gradual

- Financial infidelity and financial secrecy

- Addiction & financial instability

- Workaholism

- Religious/Spiritual financial manipulation/abuse

- Chronic underearning

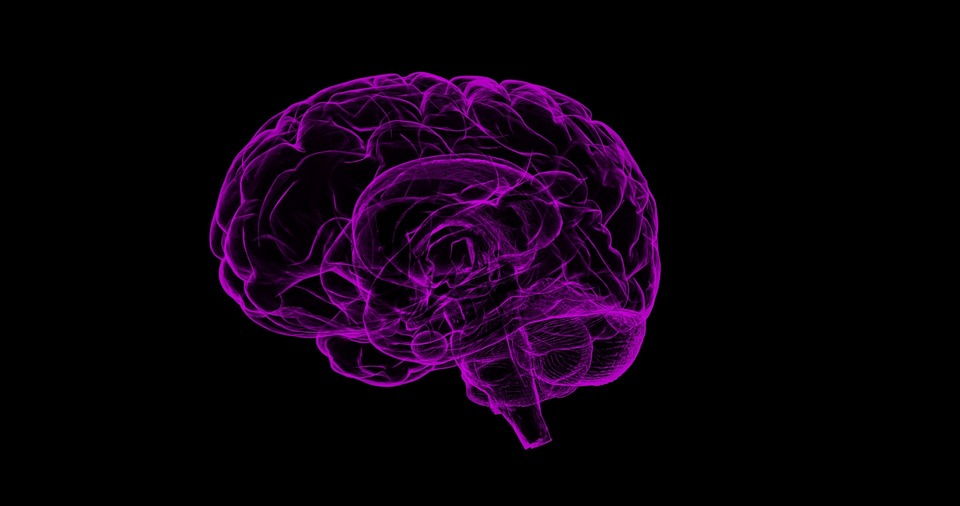

The Autonomic Nervous System

Your brain and nervous system are highly attuned to safety and security.

One part of that system is your autonomic nervous system.

When you understand that your ANS is wired to help you and also is part of what prevents you from doing what you want, you have new ways of understanding your responses to stressful financial scenarios.

These adverse financial experiences and traumas outlined above can cause multiple layers of your brain start to associate certain financial topics with threats.

These associations then can become generalized to other financial areas of your life.

Ultimately, this can lead you to shut down or shut out certain financial topics consciously and unconsciously so that your autonomic nervous system does not become activated and cue the emotions of fear, anxiety, shame, anger, and sadness.

Learning to tend to your autonomic nervous system and attachment style is critical to repairing, maintaining, and growing through your financial trauma and building towards financial intimacy.

In very approachable terms, there are three states of your autonomic nervous system.

Please see the graphic on pg. 4 of this presentation on PolyVagal theory that shows a wonderful and simple picture of your autonomic nervous system.

There are three states your nervous system can take you into when it comes to money.

- Ventral Vagal - I feel connected to the greater world

- Dr. Perry’s Calm and functional IQ of 120 - 100

- Sympathetic - I’m in danger. I need to run or fight back

- Dr. Perry’s Alert, Alarm & Fear, functional IQ 110 - 70

- Dorsal Vagal - I can’t cope. I’m collapsed and shut down

- Dr. Perry’s Terror, functional IQ 80 - 60

Healing Journey

Your biology works at a faster rate than your thoughts and behaviors. If you get overwhelmed or shut down around money there is nothing wrong with you, your nervous system has learned to respond this way to try and protect you.

With time you can help your nervous system start to reset.

The first step in addressing your financial distress is tending to your nervous system.

If you are not in a ventral vagal state then you are going to need help finding your way there.

This is where a secure attachment can be so helpful.

Secure attachment is one of the four attachment styles that you are all wired with.

In the absence of secure attachments in childhood, adults live with one of three insecure attachment patterns: anxious, avoidant, and disorganized.

Each attachment pattern has very predictable ways of showing up in relationships.

As you might imagine, people with a secure attachment will have an easier time regulating emotion within themselves and helping their partner.

Changing your attachment patterns extends far beyond reading articles about it.

It means finding and forming new relationships that provide secure relationship experiences. Please let this be an invitation to continue on your journey of healing and fostering secure attachments, a calm nervous system, and financial intimacy.

Time For Reflection

- What have you learned about your autonomic nervous system?

- How does this new understanding change the way that you think about your finances?

- How does this impact the way you and your partner will address them?

Looking at your life through this lens is not a quick fix or easy solution to the money dilemmas you’re facing, but over time will strengthen your ability to navigate both the current and future money dilemmas you will face.

After reading this article do you sense you need to go further? Then I would like to invite you into my transformational course The Couples Guide to Financial Intimacy.

If you would you like more 1 on 1 support? Then perhaps Therapy Informed Financial Planning is for the two of you. I invite you to schedule your free 30-minute discovery call today.

Wishing You Healthy Love and Money,

Ed Coambs

MBA, MA, MS, CFP®, CFT-I™, LMFT

Curious About Your Attachment Style?

Take the Attachment Style Quiz now and learn how it impacts your relationships, finances, and life!