Why Healing Your Trauma Will Improve Your Personal Finances

Jun 10, 2021

You may be wondering what trauma has to do with your personal finances.

Or you may already have some sense that these two things are connected but you have not been able to explore the relationship between your own trauma and your personal finances.

Your historical trauma and personal finances are two very large, complex, and dynamic areas of your life. Ones that can not be ignored for long without suffering significant consequences.

Finances and Trauma

Trauma inevitably impacts your relationship to money.

Trauma brings with it a host of adaptations both psychologically and physiologically, that have long-lasting effects for a period of time well after the experience of trauma.

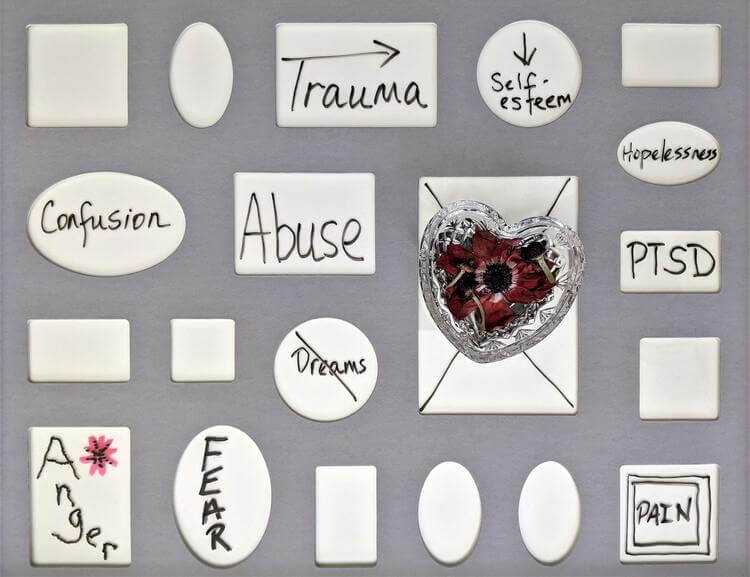

The impact of trauma may include lowered self-confidence, difficulty regulating emotions, mistrust of others, mental health struggles, and impacts on your physical health. Plus, at a deeper level, and not so easily observable, there is a link between trauma and how it integrates into the different regions of the brain and body.

Lowered self-confidence, difficulty with emotions, and mistrust of others are some of the effects of trauma that create barriers to experiencing financial well-being and financial health.

Financial well-being is a sense of general safety, trust, and direction in your financial life. It does not mean you have all the money you need, or that you don't worry from time to time about your finances, but rather you can recognize when you are experiencing financial stress and anxiety and do something productive about it.

Taking the time to explore the intersection of trauma and your personal finances is an act of courage in the face of fear, uncertainty, and often distressing sensations in your body.

Take your time as you read this article and consider what this may mean for your life and the next steps that you need to take on your journey through your life.

Trauma As Universal

The experience of trauma is universal.

No matter where you are on the journey of understanding, resolving, and healing your trauma, taking the time to read this will move you towards increased compassion for yourself and others that are important to you in your life.

Even if you don't connect with having experienced trauma in your life, someone you know does.

Defining Trauma

What can be defined as traumatic?

This is both an easy and hard question to answer.

In short, traumatic experiences are any experience that overwhelms the mind/brain/body and blocks its purpose of being an integrated system.

In everyday terms, trauma is made up of overwhelming or isolating experiences often between two people, groups of people, or natural disasters.

The challenge with defining what is traumatic is that the definition is not universal. Yet, there are experiences that are generally agreed upon as traumatic.

Exploring both your definition and the definitions given by mental health professionals of what is traumatic will likely expand your definition of what is traumatic.

A large part of providing mental health services as a marriage counselor and financial therapist has been allowing my own definition and understanding of trauma to expand. This expansion in defining and understanding trauma has greatly improved my ability to provide the necessary empathy and understanding to help couples along their healing journey.

By looking through the lens of trauma you can also shift your perspective from “there is something wrong with me”, to “some painful experiences happened to me that I need help with”.

Only then are you able to heal the trauma.

Challenges of Facing Trauma

Trauma is often associated with the unthinkable, undesirable, and painful experiences of life.

Denial is one of the many psychological defenses people use to protect themselves from the overwhelm of trauma in their lives.

Far from the only psychological defense that protects us from the overwhelm of trauma it is the one most readily used.

I will do future writing exploring other defense mechanisms common to trauma, but for now, let's just focus on denial.

Denial can be defined as an automatic psychological and physiological (mind/body) response.

Facing your historical trauma is not an easy or often pleasurable experience. This is a large part of why many people ignore, minimize, and rationalize traumatic experiences so that they don't have to re-experience the pain of that which was painful.

When a mental health professional treats trauma, the point is not to leave a person stuck in their trauma but rather to help them process through the past threats and help their mind/body return to a state of safety.

Sadly, too often people that experience trauma did not have someone there to help their minds and bodies to return to a sense of safety.

Learning to trust that another human can possibly understand and be with you through your trauma processing is a huge challenge and a worthy goal to move towards.

Benefits of Facing Trauma

Knowing this about trauma why would you want to face your trauma, especially in service of improving your financial well-being.

One of the biggest reasons is that even if you learn about money, how to manage it, make it, save it, you may still be riddled with financial fear, anxiety, shame, guilt, anger, and resentment.

Notice that these are emotional issues, not intellectual issues.

How you manage and deal with your emotions is a large determinate of how you experience your financial life and the way that you are going to interact with your significant others around money.

It may seem weird to you, but I have the good fortune of working with couples

This is not a quick fix or panacea to making everything ok, but more often than not I watch partners' resentment, frustration, fear, and anxiety slowly dissipate and move towards empathy and compassion as they come to better understand how their partners' trauma history has shaped their decision making.

This building of empathy and compassion through resolving and working through trauma opens up new opportunities for couples to resolve their chronic areas of financial conflict and come up with solutions that are mutually beneficial.

Unfortunately, most couples are stuck in patterns where the financial arrangements are not mutually beneficial, and it builds large amounts of resentment in the relationship.

Money As Complex Stimulus

Money is a complex stimulus.

What does this mean?

It means that money can and does evoke a wide range of responses.

Different topics around money will evoke different responses.

At different times with different people, you will have different responses about money.

Navigating your world and money with other people requires your ability to be dynamic and complex in order to have the best chance of experiencing financial well-being and improving your overall financial well-being.

Money Memories

Stop and think about it for a minute. How many money memories do you have before the age of five?

You might be thinking none or just a handful.

At one level this is true, but at another level, you have countless money memories before the age of five.

These first money memories are stored as implicit memories in your brain. That is the feelings and emotions associated with money begin to develop long before you can even understand the full meaning of money forming implicit memories.

By the time you are 10, you have more money memories and your financial outlook is starting to form.

Most of this is based on your experiences with your family.

These money memories set an internal money map that will guide your money decisions mostly at an unconscious level until you take time to start to reflect on your history and relationship with money.

Although you may not have money memories of financial trauma, intense stress related to trauma in the home can cause adult financial difficulties like financial instability, financial hardship, and money stress.

Curious to learn more about how your finances have been shaped by your family and your Money Memories? Check out The Family Money Tree to find out more.

Money Decisions Are Impacted By Money Memories

Bringing together the reality that you have both traumatic memories and money memories we can start to see why we have such a complicated relationship with money.

Now just to throw a monkey wrench into all of this we want to keep in mind that this is also true for your partner, and your parents, and everyone in society.

I don't share this to overwhelm you but rather to have you consider that this is an issue much larger than just you. No, it is not just you that feels overwhelmed by your financial life.

If you have traumatic experiences that lowered your self-esteem, you are more likely to spend or hoard money as a way of trying to create protection for yourself causing you to miss out on close and intimate secure healthy relationships.

I have worked with people who have spent too much on dinner, blown their 401(K), ran up credit card debt on vacations, lost money on complex investment schemes, hid spending from partners, ruminate on whether their partner really loved them, long drawn out divorce, alimony, and child support battles.

In every one of these cases, the presenting money issue had connections with childhood trauma that has included emotional abuse/neglect, physical abuse/neglect, sexual abuse/incest, parental divorce, mental illness, and addiction.

These adverse childhood experiences profoundly shape the developing sense of self of the child that grows into the adult making significant financial decisions.

Budgets and Balance Sheets

Coming around to the very practical side of personal finance, everyone needs a certain degree of financial literacy.

This means managing your budgets and balance sheets.

There is the technical knowledge of how to manage the money coming in and out of your life as well as the long-term need to save for your own retirement.

Although a financial professional can help you with these things, it's important to understand them yourself.

Getting a hold on this information is foundational for building financial well-being but will not be enough to get you there if you have unresolved traumatic experiences and money memories.

This is where the harder work of healing and recovery comes into place.

If there are negative evaluations of yourself, your partner, and the ways that these key financial tools are used then that is a clue that there is something deeper to look into.

Working towards exploring the intersection of your trauma history and its impact on the way that you manage your finances is no small task or journey.

I know from personal experience and walking many clients along this path.

At the same time, watching how I have felt more open to new money experiences and comfort with my family's increasing wealth while watching clients literally transform in front of my eyes gives me the confidence to encourage you to explore, understand, heal and grow from your past into a present that is meaningful for you.

While money won't solve all your problems, having a good relationship with yourself and money will help you solve many problems.

If you'd like to explore deeper how your finances impact your relationship, you will love The Couples Guide to Financial Intimacy.

Would you like more 1 on 1 support? Then perhaps Therapy Informed Financial Planning is for the two of you. I invite you to schedule your free 30-minute discovery call today.

Wishing You Healthy Love and Money,

Ed Coambs

MBA, MA, MS, CFP®, CFT-I™, LMFT

Love The Blog Check Out The Podcast

Curious About Your Attachment Style?

Take the Attachment Style Quiz now and learn how it impacts your relationships, finances, and life!